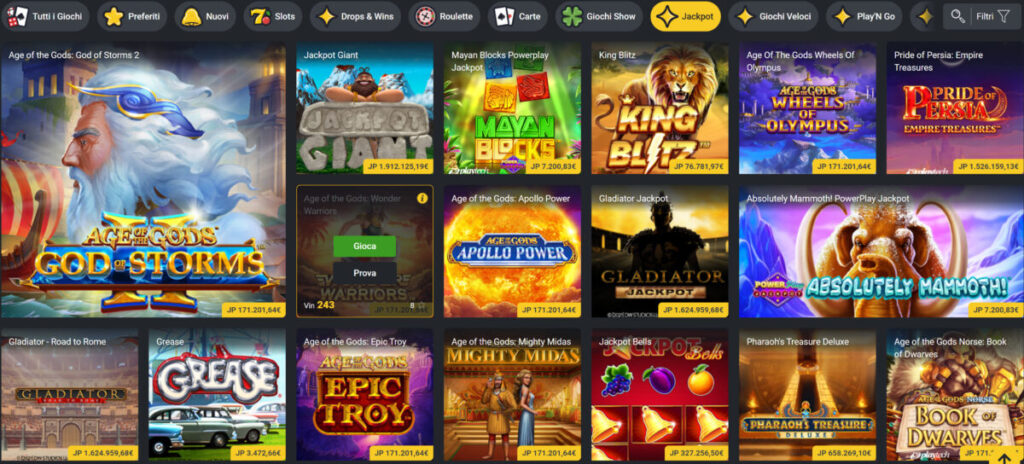

Such, if you decide to discover a particular type of video game for example while the harbors, you would provides similar risk of winning because the professionals whom chose to put additional money. However, you will probably have to test a few more moments within the acquisition so you can withdraw a high matter. It all depends about what local casino you select and that gambling establishment’s online game confidence the game business it prefer. Some have more slots, although some may have a lot more wheel revolves.

Devils Number no deposit: $5 Deposit Gambling enterprise Australian continent

Including items in which you to partner is a nonresident alien early in the newest tax season, but a resident alien after the season, and the most other spouse is actually a nonresident alien in the bottom of the season. A comparable choice is readily available in the event the, at the end of the brand new tax 12 months, one partner try a good nonresident alien plus the almost every other companion try a good You.S. resident or citizen. For individuals who in past times made one to possibilities and is also nevertheless inside feeling, you certainly do not need to really make the alternatives informed me right here.

- One to office repaid Henry an entire terrible paycheck of $dos,800 for these functions.

- Fixed or determinable income boasts attention, bonus, leasing, and you may royalty money you don’t claim to be efficiently linked money.

- You can utilize Form 1040-NR since the report, but make sure to enter “Dual-Reputation Declaration” along the better.

- It amount could be welcome on the use of a kid that have special needs no matter whether you have being qualified expenditures.

- Obviously, don’t forget to pay attention to the brand new terms and conditions of the advantage.

A manager character amount (EIN) becomes necessary when you’re involved with a trade otherwise company as the a best owner and also have group or a professional retirement package. The possibility relates to all money away from real-estate based in the usa and you may held on the production of income and you can to any or all money away from one need for such as assets. For example earnings away from rents, royalties away from mines, petroleum or gas wells, and other natural info. In addition, it has gains in the product sales otherwise exchange out of timber, coal, otherwise residential metal ore which have an organised economic attention. Ted Richards entered the usa in the August 2023 to perform individual features regarding the You.S. work environment of an international workplace.

Get together security deposits and you may book online simplifies the new commission procedure. Explore possessions government software including Baselane to cope with purchases safely and you can Devils Number no deposit effortlessly. Inquire further to own an itemized listing which explains why he’s perhaps not coming back the protection put. If your property owner will not pay both you and doesn’t show you as to why, you could file facing them on your local small-claims judge.

C. Who Must File

At the Gamblizard, i just recommend probably the most safer lowest deposit. All of our options processes comes to careful assessment based on very important requirements. Foremost, i scrutinize the newest gambling establishment’s certification and you may regulatory back ground. Opting for any of the internet sites to your our checklist guarantees an excellent wonderful and you will trustworthy interest. If you are your protection are our concern, we simply promote casinos we’d confidently enjoy during the ourselves. Any type of gambling enterprise you decide on, you’re set for a rich games diversity, anywhere between 450 headings so you can a massive 3000+.

CIT Lender has a different incentive to their Rare metal Family savings, awaken so you can $300 once you deposit at the very least $twenty-five,one hundred thousand within the very first thirty day period. This really is accessible to present and you will clients, that’s a nice contact. Truist Lender will provide you with $eight hundred after you open up an alternative Truist Bright, Truist Standard otherwise Truist Measurement checking account.

Schedule P (541) should be completed it doesn’t matter if the newest house or faith are susceptible to AMT if a living shipping deduction try claimed to the range 18. Loans disallowed due to the $5,100,000 restrict could be sent more. Multiply line 20b by higher speed relevant to people. Essentially, the newest property or believe will have to complete Schedule P (541) when the a full time income shipment deduction try claimed below IRC Area 651 otherwise 661. Since the real shipping can also be relatively be anticipated in order to surpass the new DNI, the newest believe must contour the fresh DNI, looking at the newest In the middle of, to choose the total enter into online 15b. Establish to the an alternative agenda any other registered deductions that will be perhaps not deductible someplace else on the Mode 541.

FanDuel Promo Code: Win $150 Added bonus for NBA, NHL & MLB Games

Moving into a different residence is expensive for many, but also for lowest-income renters, it may be thus expensive they could’t move. Apartment teams display screen applicants that looking to indication a lease. This type of financial tests range between guidance from your own credit report, rental record, and you can earnings supply. The safety deposit amount is founded on the results of the tests, which implies debt condition.

Come across Real property Obtain otherwise Loss, prior to, less than Efficiently Connected Money. Items especially incorporated as the fixed otherwise determinable income is actually desire (besides OID), dividends, bonus similar repayments (discussed inside the section 2), rents, premiums, annuities, salaries, wages, or any other compensation. An alternative bonus or attention commission obtained less than a bonds financing deal otherwise a-sale-repurchase exchange is treated the same as the new quantity gotten for the the brand new moved shelter. Other stuff of money, such royalties, may also be at the mercy of the fresh 30% taxation. Income you receive in the taxation 12 months that is effortlessly connected with your change or team in the united states is, after allowable write-offs, taxed at the prices you to affect U.S. owners and residents. People overseas resource earnings that’s equal to almost everything from income revealed a lot more than try treated because the efficiently related to a good U.S. trading or organization.

Exactly how much defense deposit is landlords costs?

Compensation you will get since the a member of staff in the form of the new following the perimeter advantages is actually sourced on the a geographic foundation. Your dictate the period that the brand new settlement is attributable centered on the points and you may things of your circumstances. Such as, some compensation you to especially means a time period of go out filled with several diary decades are owing to the whole multiyear period. Play with an occasion foundation to figure your U.S. resource settlement (aside from the brand new fringe benefits talked about less than Geographic Basis, later).

The newest gift tax can be applied because this is an exchange away from real property located in the usa, whether or not Chris is actually a great nonresident and not a citizen away from the united states. You.S. residents and you can residents is actually subject to a maximum price from 40% which have exception out of $5 million indexed to own rising cost of living. Nonresidents are at the mercy of the same taxation costs, however with different out of $sixty,one hundred thousand to own transmits from the dying simply. The liberties set aside.The Area Credit Union (YNCU) are a licensed credit connection functioning within the, and beneath the laws and regulations of, the newest province out of Ontario. Qualified deposits inside the registered profile features limitless publicity from Economic Functions Regulating Authority (FSRA). Qualified places (maybe not in the entered accounts) are insured around $250,000 from Monetary Characteristics Regulating Expert (FSRA) .

We cannot make sure the precision of the translation and will maybe not end up being accountable for people wrong guidance otherwise changes in the fresh webpage style because of the new interpretation software unit. This page don’t range from the Yahoo™ interpretation software. To possess an entire listing of the fresh FTB’s formal Language profiles, go to Los angeles página dominant en español (Foreign language home page). In some cases we may have to name you for further advice. Done column An off column H to choose the amounts to help you go into to the Function 541, Front side step one, line step 1 because of line 15b.

Functions performed because of the a partner otherwise minor son away from nonimmigrant aliens for the classification of “F-2,” “J-2,” “M-dos,” and you will “Q-3” is actually protected under social shelter. If you are somebody in the a residential union, and the partnership gets rid of an excellent U.S. real property focus from the a gain, the relationship have a tendency to keep back income tax to your quantity of get allocable in order to their overseas couples. Your own show of your income and you will income tax withheld might possibly be advertised for you to the Form 8805 or Mode 1042-S (in the example of a PTP). A partnership which is in public areas exchanged have a tendency to withhold tax on your own genuine distributions from effortlessly linked earnings. Next earnings isn’t subject to withholding in the 31% (otherwise straight down pact) rates for individuals who document Form W-8ECI on the payer of your own income.

In the event the, once you have generated estimated income tax costs, the thing is that the projected income tax is actually considerably increased or diminished since the from a general change in your revenue or exemptions, you should to alter your leftover estimated taxation money. Generally, less than these types of preparations, you are at the mercy of societal protection taxation simply in the united states where you are doing work. Replace individuals are temporarily acknowledge to your Us less than point 101(a)(15)(J) of your Immigration and you may Nationality Operate.